By Sharon Frankenberg,

Attorney at Law

Society tries to deter crime by devising a variety of punishments for individuals who commit those crimes. These range from the assessment of fines and probation to incarceration and even the death penalty. I want to focus here on one method of attempting to deter criminal acts committed for financial gain: the forfeiture of profits and proceeds acquired and accumulated as a result of such criminal activities. The current criminal law permits forfeiture as punishment for a crime but there must be a criminal conviction. That means guilt must be proven beyond a reasonable doubt and all Constitutional protections must be afforded the defendant, including the right to legal counsel.

On the other hand, under both federal and state laws there are forfeiture procedures that are considered civil, “in rem” (Latin for “against a thing”) proceedings. In a criminal proceeding, the Government prosecutes people. In a civil forfeiture proceeding, the Government is going after property rather than a person. This legal fiction relies on the idea that the property itself has violated the law. Generally speaking, law enforcement officials are permitted to seize property that they assert has been involved in some illegal activity specified by statute. This asset forfeiture process has been commonly used in the “war of drugs” since the mid-eighties. “Any property…acquired by or received in violation of any statute, or any property traceable to the proceeds from the violation, is subject to judicial forfeiture, and all right, title, and interest in any such property shall vest in the state upon commission of the act giving rise to the forfeiture.” (Tenn. Code Annotated Section 39-11-703). This means that in these civil asset forfeiture proceedings, the owner of the seized property does not have to be convicted or even charged with a crime. The owner is entitled to certain forms of notice but may have to post a bond and the burden of proof falls on the owner to prove that the seized property should be exempt from forfeiture.

“Unless provided in statute, innocence of the owner is typically not a defense. Furthermore, courts interpret the statutory defenses stringently. For instance, courts may apply an objective standard to determine if the owner should have had knowledge of the property’s illegal use, rather than require proof of actual knowledge. The owner may argue that no crime ever occurred, that the government lacked probable cause, or that the property is not closely enough connected to the crime to be considered an instrumentality or proceeds.” https://www.law.cornell.edu/wex/forfeiture

Tennessee has a statute (Tenn. Code Annotated Section 39-11-701) which explains the intent of the general assembly to provide law enforcement agencies and district attorneys general the necessary tools to punish and deter the criminal activities of professional criminals and organized crime through the enforcement of effective forfeiture and penal laws. This intention is balanced by the stated intention not to unduly interfere with “commercially protected interests.” The civil asset forfeiture process has been incredibly profitable for law enforcement at both the state and federal levels. According to the Heritage Foundation’s website http://heritage.org, “state and local law enforcement can…seize property by partnering with federal law enforcement officials in a system called ‘equitable sharing’” and annual payouts to states totaled $657 million in fiscal year 2013.

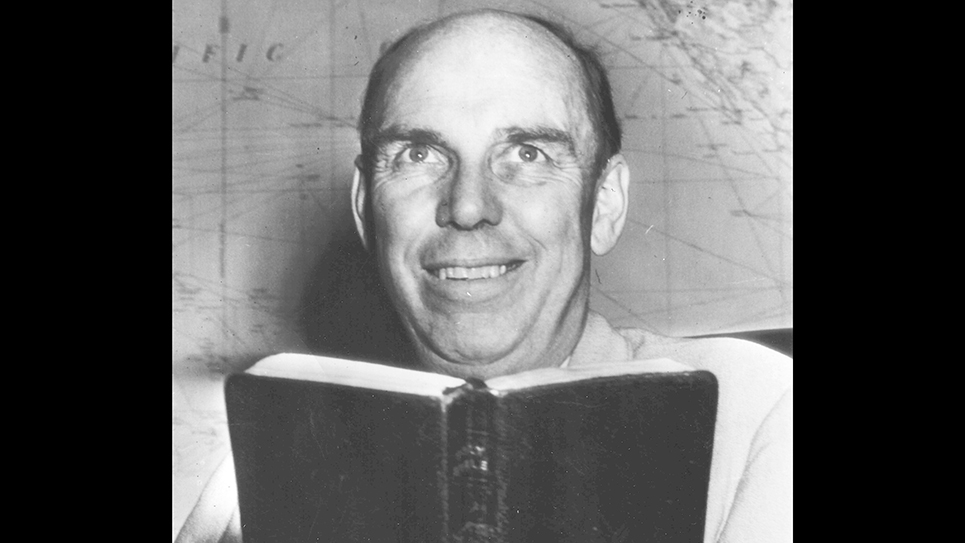

If you are involved in a forfeiture proceeding, you should seek the assistance of legal counsel immediately so that your rights may be protected. Sharon Frankenberg is an experienced attorney licensed in Tennessee since 1988. Her office number in Knoxville is (865)539-2100.