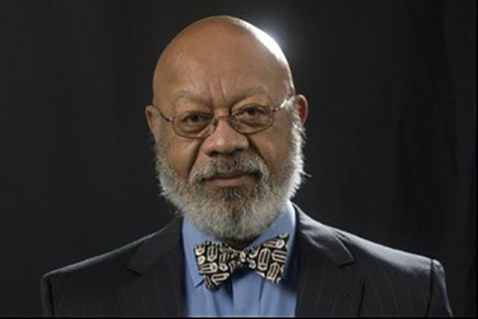

By Dr. Harold A. Black

blackh@knoxfocus.com

haroldblackphd.com

Although we have no national interest in Ukraine, ground troops are being sent to NATO countries in Eastern Europe to counter the buildup by the Russians on the Ukraine border. I have not seen a compelling reason for involving America in what is strictly a European affair but in this article, I want to address one of my pet peeves.

For a number of years, I have sent to my representative (but not Tim Burchett) and my senators (not Marsha Blackburn) the idea that active-duty military should be tax exempt from all taxes, federal, state and local. Nationally, the exemption would apply to federal income taxes. Locally, it would apply to all sales taxes. The reply from the politicians always was that due to the federal deficit, such a proposal would fail due to the budgetary implications. I don’t care. The budgetary impact on a trillion dollar budget would be trivial. The tax exemption should be part of our gratitude for their service. There is a precedent. Foreign service personnel in the United States do not pay any taxes at all. The Diplomatic Tax Exemption Program provides sales and use, occupancy, food, airline, gas, and utility tax exemptions to eligible foreign officials on assignment in the United States. When I was living in DC, foreign personnel would produce a card that exempted them from sales tax at the time of purchase. Why don’t we do the same with active duty personnel? Currently those serving in a combat zone can be exempt from Federal income tax. I want to extend that to all active duty personnel regardless of where they are stationed. Also combat pay should be increased.

I am no tax accountant but at the federal level, all military would have no automatic deductions for income taxes taken from their paychecks. At the state and local levels, the exception could come as a rebate or even a card to be scanned at point of sale. Although it runs contrary to current tax code, I recommend instituting the simplest and least costly way for military personnel to take advantage of the changes.

Currently only two states exempt active duty military from paying all state income taxes while fifteen others allow a portion of military pay to be exempt from state taxes – usually combat pay. Thirty three states exempt military retirement pay from state income taxes. I wish that this were extended to all states. Since Tennessee does not have an income tax, it exempts military payment of motor vehicle registration taxes. I would like this extended to a rebate on sales taxes. If any state did not want to exempt military pay, then there should be a 100% write off on federal income tax filings by military personnel of any taxes paid.

I think it is time to show our military and their families our appreciation for their sacrifices, their patriotism and their service. A tax exemption at the Federal, state and local levels would be a start.