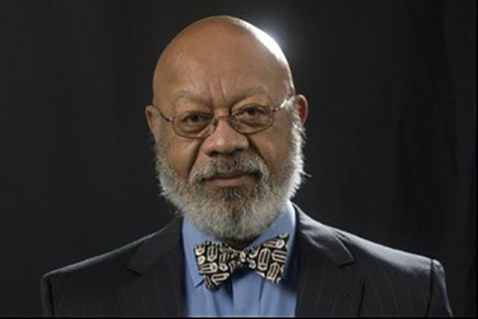

By Dr. Harold A. Black

blackh@knoxfocus.com

I am often asked if the current inflation is permanent or transitory. The answer is “it depends.” The administration has tried to convince us that inflation is transitory. The Fed concurred. Nonetheless, the concern on the part of the public is real. No matter the measurement, prices have been rising faster than they have in more than a decade. Consumers can see it for themselves in rising prices for food, gasoline and housing. From the standpoint of economics, rising prices are only a concern if they outpace changes in consumer income. If the rise in prices is greater than the rise in income, then real income (purchasing power) falls. On the other hand, if prices rise by less than the rise in income, then purchasing power increases. However, for those whose incomes are relatively fixed, like retired seniors, inflation is particularly worrisome. Seniors who rely on social security, CDs and/or pensions are rightly worried. While Social Security payments have an inflation adjustment, CDs and pensions typically do not. CD rates have been kept abysmally low by the Federal Reserve’s zero interest rate policy initiated during the great recession of 2008. Seniors have suffered from their net worth falling yearly since 2008.

The government at first tried to convince the public that the increase in prices was temporary citing the effects of COVID. There were shortages in virtually every sector, which cause increases in prices. Lumber prices were at an all-time high driving up building costs. There was a shortage of chips, creating a shortage in new cars, driving up both new car and used car prices. Oil prices were adversely affected by hurricanes impacting production. Certainly, the government assured us that as the impact of the pandemic waned, the economy would recover and prices would start to fall as shortages disappeared.

The government by looking at temporary price movements assumed that each would correct themselves going forward. However, the government and many observers are ignoring the underlying cause of inflation and why this time, the increases in prices will not be transitory. Inflation – which is a rise in the general level of prices – will not occur unless there is an increase in the supply of money. Milton Friedman once said that inflation is a purely monetary phenomenon. Money grows either through the banking system lending money and/or the Federal Reserve buying government securities. Since the great recession, there has been an unevenness in bank lending but not in Fed purchases of government securities. Currently, the Fed is buying $120 billion a month in Treasury bonds and has been doing that for some time. Since the Federal government has been spending money like the proverbial drunken sailor, it has been financing the expenditures by selling bonds to the fed. All that spending and money creation are the sources of long-term inflation. In fact, many observers have wondered what has taken inflation so long to manifest itself. Perhaps the answer is the amount of slack in the economy caused by the shutdowns and slow economic activity.

Now, we have gotten ourselves into a real mess (technical economics term). The enormous increase in money and the resulting inflation are not being offset by increasing growth. The Biden administration is certainly not going to decrease spending. Quite the contrary, it is introducing bills to dramatically increase spending levels going forward. This will mean more inflation not less. Instead of increased economic growth, most forecasting models show anemic growth in the future. This would likely mean a return to the days of inflationary recession where we have high prices, high unemployment and low growth. Thus, the economic problems caused by an insatiable government and a compliant Fed will manifest itself in continuing inflation regardless of assurances to the contrary by the administration.