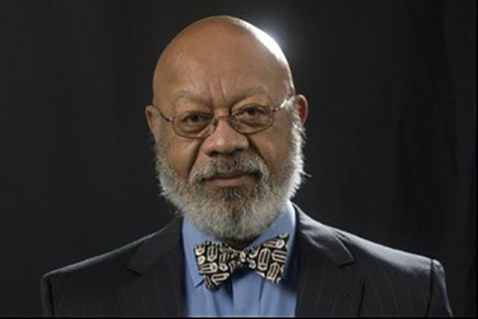

By Dr. Harold A. Black

blackh@knoxfocus.com

Although not a popular opinion, I have always been a fan of the structure of the Fed and the concept of Fed independence. It has its critics but show me a better system and I will favor it. The Fed consists of seven members of the board of governors in Washington, D.C. and 12 reserve banks located strategically (circa 1913) around the country. The main policy board is the Open Market Committee made up of the seven governors, the president of the New York bank and four other reserve bank presidents who serve one-year terms on a rotating basis. One of the governors is appointed by the President of the United States and confirmed by the Senate to serve as chair for a four-year term. The governors are appointed to 14-year terms and cannot be re-appointed unless their initial appointment was to fill a vacated seat. The genius of the system is twofold. First, once appointed the governors cannot be fired by the president – only impeached by Congress. Second, the Open Market Committee by including the reserve banks reflects conditions outside of Washington, D.C. Research in the past has shown that the reserve bank presidents residing outside of Washington are less susceptible to political pressures. Moreover, although the chairman is the most visible member of the Board of Governors, the chair has only one vote and must convince the others to follow whatever policy the chair favors.

The notion of Fed independence stems from not only the tenured security of the governors and chair but also from the Federal Reserve being off budget, receiving its operating revenue not from the Congress but from the assessments on the banking system. Thus, Congress cannot threaten to adversely affect the Fed’s budget if there is a disagreement. Given that in the past, most Congresses and presidents have pressed the Fed for low-interest-rate policies and easy money, a Fed that is directly under the control of the executive would most likely pursue monetary policies that are even more inflationary.

This is not to say that the Fed is immune to political pressures. Research has shown that the Fed has in the past pursued easy money policies close to an election where the incumbent president was running from re-election. Also, the Fed is also more likely to pursue policies more agreeable to the president when the chair is up for reappointment as chair. Such is the case today. The Fed chair wants to be re-appointed to another four-year term and is using monetary policy to support the fiscal policy actions taken by the Biden Administration. Consider that all the trillion-dollar packages could not exist if the Fed were not willing to be accommodative by purchasing Treasury bonds. Given the size of government spending and the resulting deficits, Treasury bonds must be sold. There is a limit to which the public will lose its appetite to buy bonds. The Treasury also sells bonds to foreign governments and central banks. The Fed fills any void and steps in to purchase bonds providing financing for the increased government expenditures. This is called “monetizing the national debt” where the Fed provides money creation as a permanent source of government spending. Since the beginning of the pandemic, the Fed has monetized over half of the increase in government spending buying over $2.5 trillion in US Treasury bonds. The Fed expanded its balance sheet from about $4 trillion to around $8.4 trillion and now holds nearly 20 percent of the national debt.

The current Fed chair has been part of this accommodation process from the very beginning, clearly lobbying to be reappointed by Biden. Treasury secretary Yellen has endorsed his reappointment as has a “centrist” Democrat on the Senate Banking Committee. However, “progressive” senators are backing a more leftist member of the Board of Governors, wanting the Fed to institute policies promoting climate change and addressing inequality. Although these are clearly not in the traditional role of the Fed, the aggressive monetizing of the debt isn’t within that role either.

While the Fed is independent, it is still a political animal. The question is if this particular Fed will stop being accommodating once inflation (which also results from the Fed’s actions) continues to surge, the economy slows down and the value of the dollar craters. One can only hope that at some point, the Fed will put the health of the economy above the whims of the country’s political class.