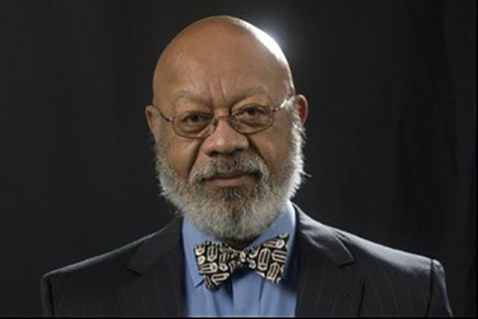

By Dr. Harold A. Black

blackh@knoxfocus.com

Politicians always make the appropriate clucking sounds when they are pandering to seniors. They will defend the Ponzi scheme that is Social Security to the death and oppose any change to the bankrupt system no matter how reasonable. It makes the politicians appear to be defending seniors when in reality they really could care less for their welfare. One bit of evidence is that the Federal Reserve has been waging war on seniors since the economic collapse of 2008. The Fed has pursued a (basically) zero interest rate policy that has financially harmed those seniors who depend on rates from CDs to supplement their retirement income. In essence the Fed is waging war on savers in general and seniors in particular. Have you checked what saving rates including those on CDs are yielding? It is criminal. Yet I have not heard one politician of either party complain about the Fed’s policy.

The low interest rates are a result of the Fed’s accommodating the massive increase in government spending over the past 13 years. By purchasing Treasuries, the Fed drives down their rates. The Treasury rate is considered the base rate in the market and commercial rates are loosely tied to it. If the Fed rates were not being artificially constrained then interest would rise across the saving/investment spectrum and seniors would again receive attractive rates. However, the Fed, the executive branch and the Congress have decided that catering to the investment class is more important than the financial condition of savers. As a result, the net worth of seniors has been declining ever since the Fed instituted it’s low interest rate policy.

Interest rates also directly impact the servicing of the national debt by the Treasury. Keeping interest rates low means lower costs to the Treasury which must pay interest and principal on all the debt issued to finance government spending. For example, at today’s debt levels a one percent increase in interest rates would increase the Treasury’s debt servicing costs by $225 billion – the GDP of Kentucky. If interest costs would rise by two percent (still below their historic average) the cost of total debt service would be $750 billion. Last year, the budget for national defense was $720 billion. Thus, the profligate ways of our Federal government has put the country in a bind. We have become a junkie nation dependent upon the drug of ever increasing spending. Every dollar spent creates a constituency that will protest mightily if a penny is reduced. Hence, not a peep from the politicians about the Fed’s war on savers. It is more important for them to be re-elected than to address the real problems faced by the country. Tragically, instead of making things better, they are making things worse. The Biden proposals alone account for more than $6 trillion in new spending. This will add even more pressure on the Fed to keep interest rates low continuing its war on savers and on seniors. I have always been an optimist about the resiliency of this country and its ability to adapt to new and onerous burdens imposed by the government. I now have my doubts.